It’s an understatement to say that it’s been an exciting four years since Title III of the JOBS Act legalized early-stage companies raising investment capital from the public. And 2020 was the biggest year yet for equity crowdfunding. The growth in popularity of this alternate route to startup capital shows its potential to democratize and diversify capital, both for founders and investors. In today’s post, we’ll look at some equity crowdfunding insights from the unprecedented year that was 2020.

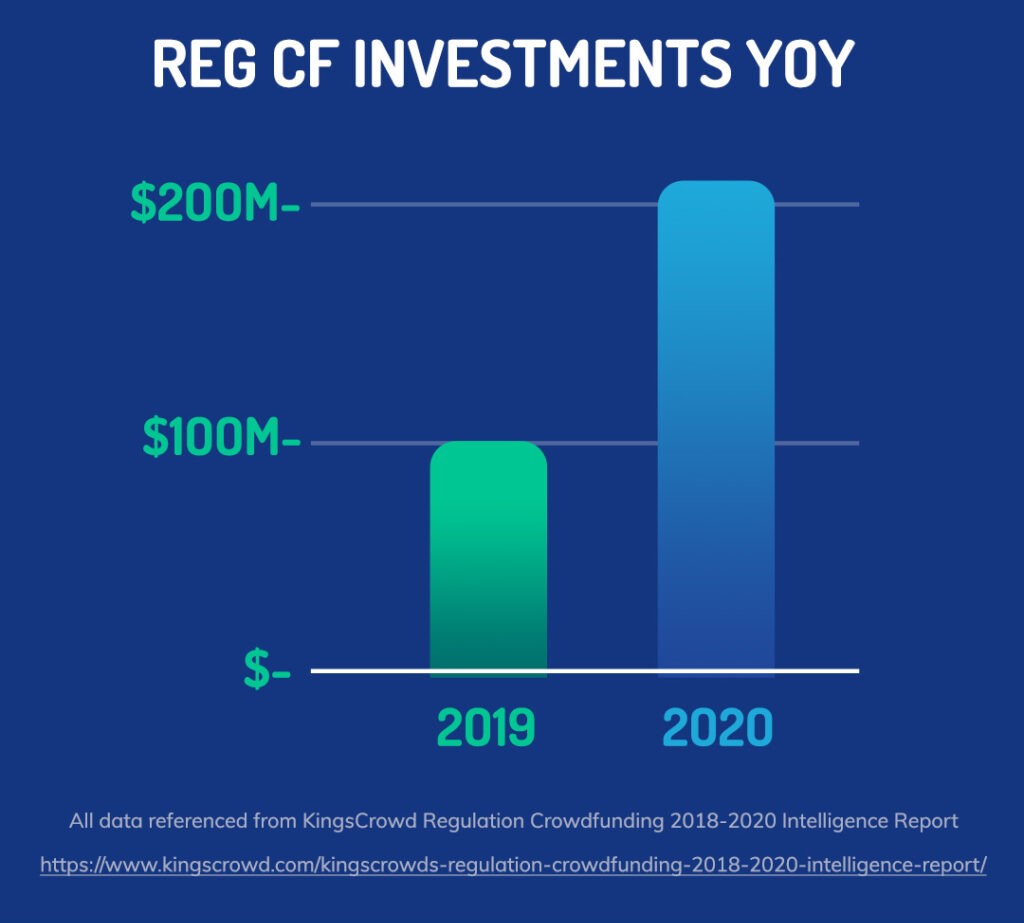

Equity Crowdfunding is Exploding in Popularity

More than $210 million was invested in Reg CF campaigns during 2020, representing a 110% YoY growth from 2019’s total funding.

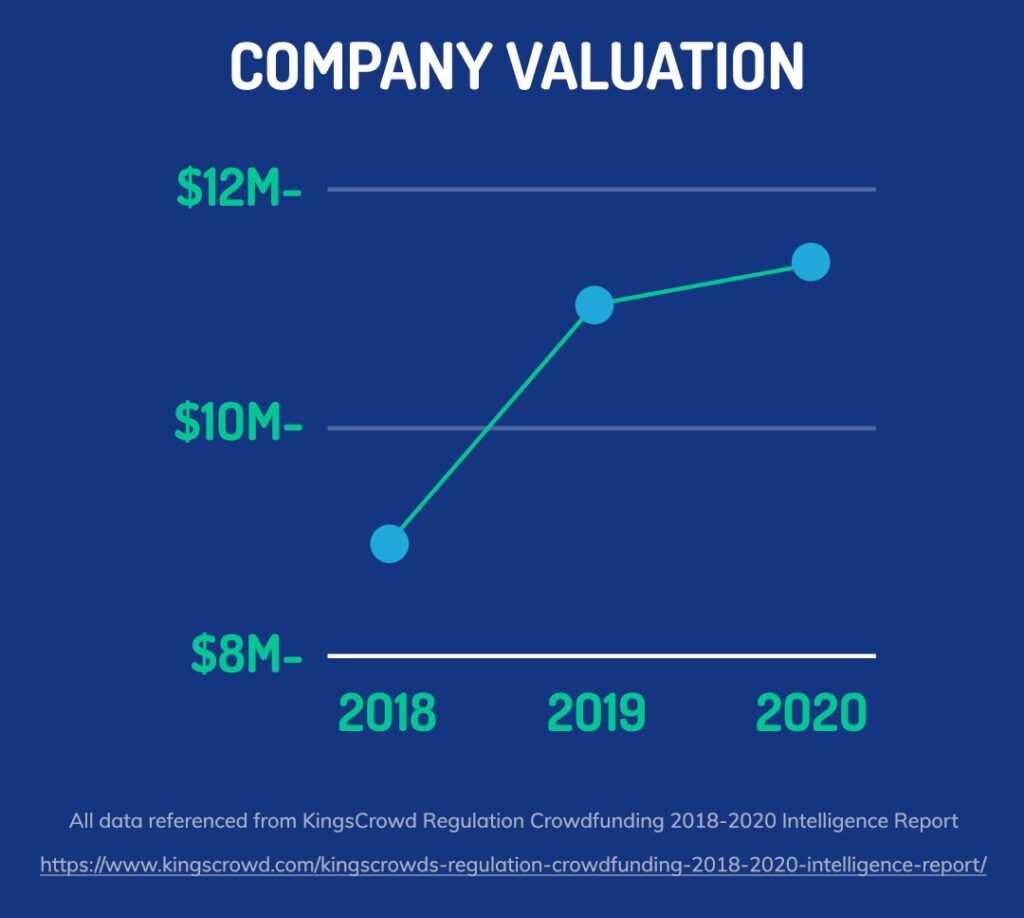

Average Company Valuation is Growing

The average valuation of 2020 companies was $11.35 million, a 24% increase from 2018 and up slightly from 2019’s $11.19 million (the slower growth from 2019 to 2020 likely being a side effect of the pandemic).

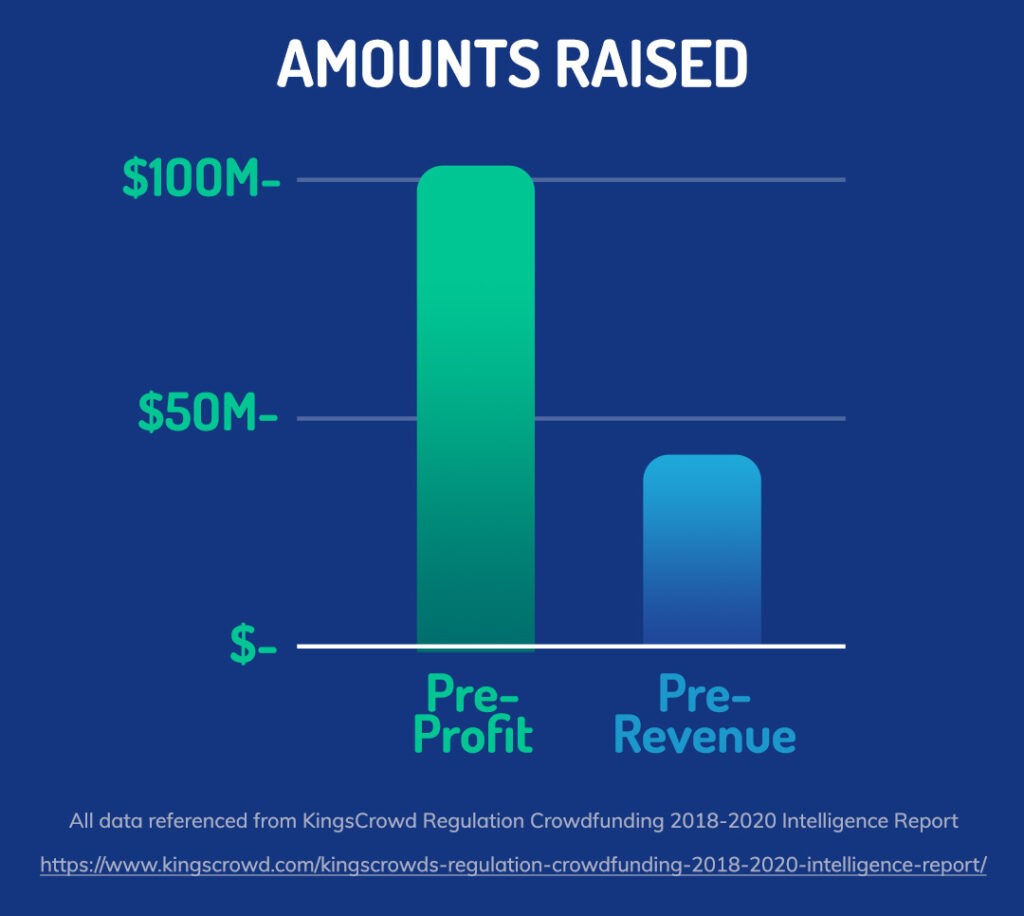

Pre-Profit Companies Are Raising More Than Ever

The companies raising the most were pre-profit (earning revenue) with $104.7 million in investments, followed by pre-revenue stage companies with $40.1 million.

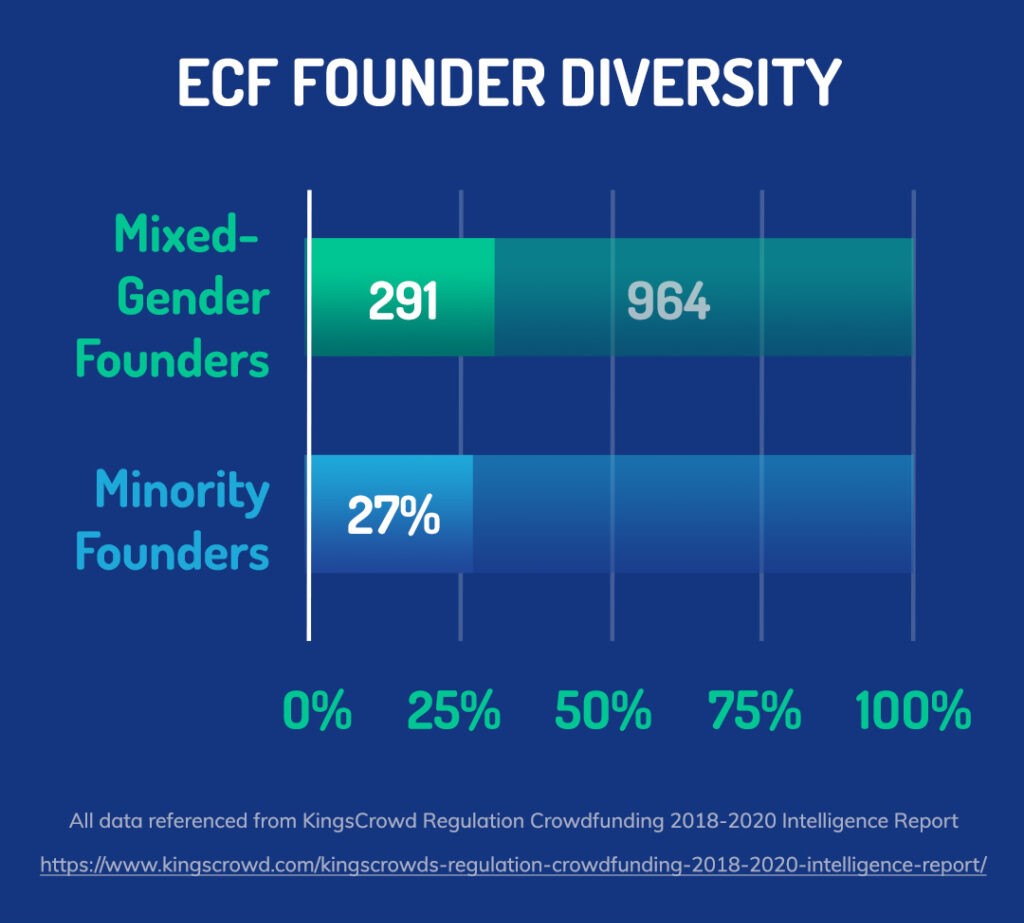

Diversity is at a Record High

2020 brought a significant increase in diversity to equity crowdfunding: mixed-gender founding teams made up 291 out of 964 companies, while 27% included minority founders.

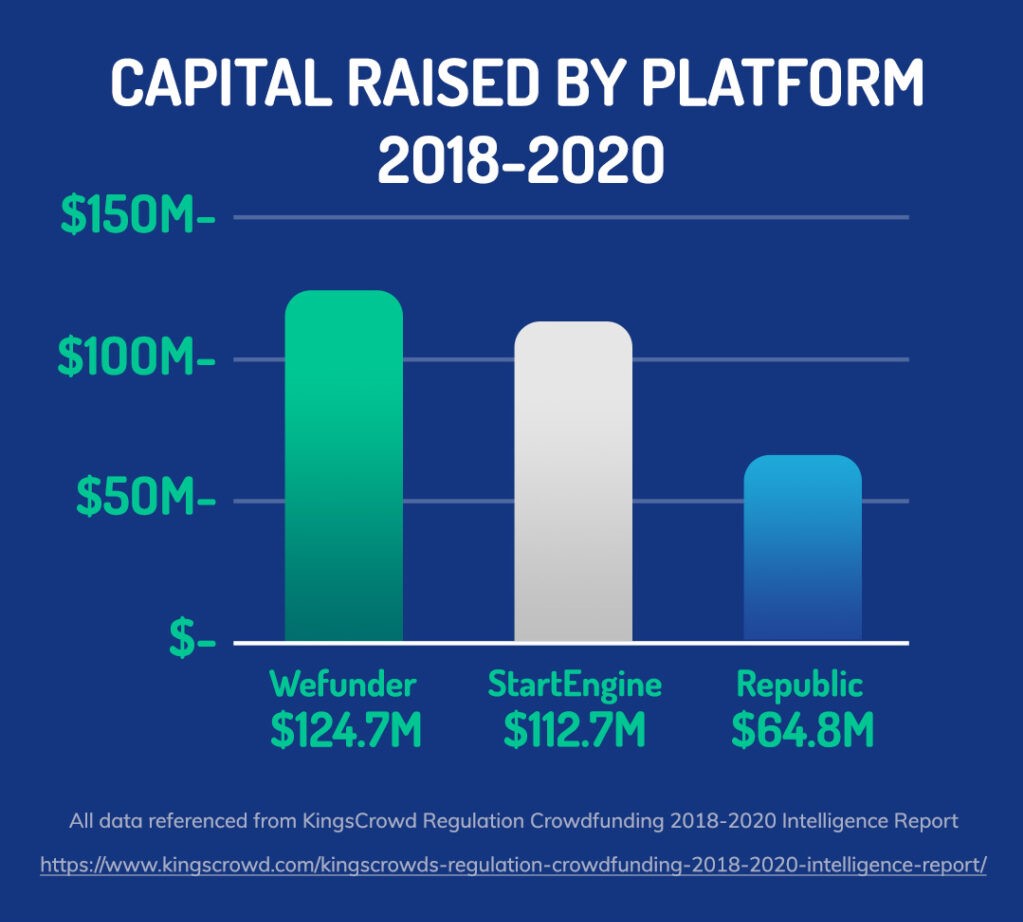

The Most Capital Has Been Raised on Wefunder

The majority of capital raised in the online private equity market comes from three main platforms: Wefunder, StartEngine, and Republic. From 2018-2020, Wefunder saw investments of $124.7 million, and StartEngine and Republic reached $112.7 million and $64.8 million respectively.

2021—Another Record-Shattering Year

This year is poised to be an even bigger, more impactful year in equity crowdfunding. Earlier this year, the SEC raised the limit for Reg CF offerings from $1.07m to $5m, adding much-needed fuel to the ECF engine, and further enabling small companies to gain access to more capital faster while making ECF a much more attractive funding route to a much higher number of companies.

The SEC amendments also served to liberalize investor investment limits, rationalize communication rules, and significantly increase awareness around this alternate route of funding.

As of this year, new rules also let founders run what’s called “test-the-water” campaigns (TTTW), allowing them to solicit investors’ interest before going through a lengthy filing process.

Startup founders eager to get into the game should look at the 2020 stats—indicators of the number of successful deals and active investors on the top platforms—when searching for the right equity crowdfunding platform and strategy for their campaign.

Our Data-Driven ECF Approach Has a 100% Success Rate

At Arora Project, we’re excited about equity crowdfunding continuing to make room for innovative, skilled, and diverse founders, while making early investment opportunities accessible to everyone—not just the wealthy few. And we know the importance of using the latest data to develop a strong, conversion-driven approach to each individual equity crowdfunding campaign.

We’re always happy to help fund the next big thing. Are you ready to take your venture to the next level?

Want to learn more? Check out KingsCrowd’s Regulation Crowdfunding 2018-2020 Intelligence Report for the full scoop.