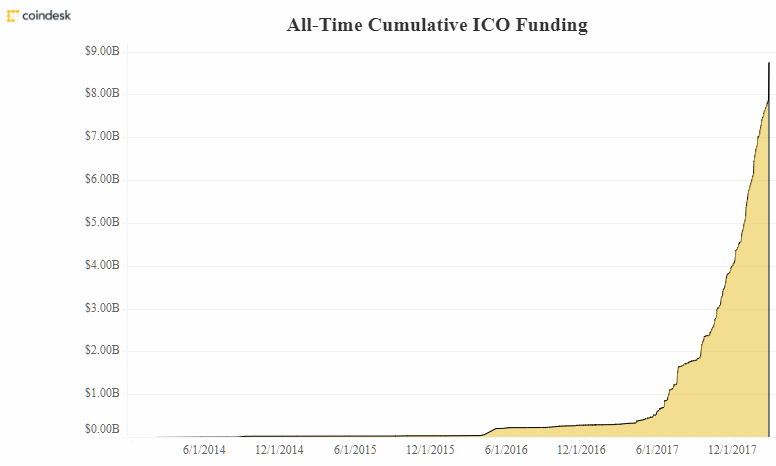

With over $8.74B in all-time cumulative funding, Initial Coin Offerings are starting to peak the interest of entrepreneurs and businesses in all industries. And, if you’re not currently following and researching ICOs, now’s the time.

Before we dive into the meat of this article, I wanted to point out a few more metrics about Initial Coin Offerings. The following will really drive home the need for understanding and potentially using an ICO for your business/startup:

* Since February 2017, Monthly ICO Funding has increased by nearly 100x.

* The average ICO in 2018 is raising $33 Million.

* There are roughly 50% more ICOs taking place in 2018 than 2017.

By contrast, the average traditional crowdfunding campaign raises between 5–10K, and the all-time cumulative funding is closer to $3.07B. (Based on our own calculations.) This means that ICOs have raised nearly 3x the funds in almost a third of the time.

With the importance and scale of ICOs understood, let’s dive into how Initial Coin Offerings are both similar and dissimilar to traditional crowdfunding:

What Are Initial Coin Offerings

ICO, standing for Initial Coin Offering, is the creation and selling of virtual coins or tokens to fund the development of a digital platform, software, project, or product. Backers can exchange cryptocurrencies or fiat currency (USD) for the virtual tokens.

There are two kinds of ICOs, which are based on the usage of the token being offered. Utility based tokens are used to access the platform, use the software or participate in the project. These are generally the most popular kinds of tokens to offer in ICOs since they are regulated differently.

The other form of ICOs offer tokens as a form of security. They don’t provide a utility, but are rather sold and purchased as a speculative or investment token. Backers will purchase thsse with the expectation of making a profit later when resold. These types of ICOs are dying out do to regulatory pressure (which we will cover in another post).

How Do ICOs Compare to Crowdfunding?

We already covered some of the financial differences in the opening paragraph, but here we wanted to focus on more of the fundamental differences between ICOs and crowdfunding.

The easiest way to view the two is that ICOs are a subcategory of crowdfunding, just like equity crowdfunding. So, because of that, they have a lot in common. In fact, ICOs which sell utility and security based tokens still operate on the principle of raising funds via the general public, like crowdfunding! The main difference between the two is that traditional crowdfunding sells a physical product or service while ICOs with utility tokens give you the ability to do something within a blockchain ecosystem and with security tokens, they simply give you equity within the company

Other differences are the audiences and the way rewards are distributed. A Kickstarter or Indiegogo campaign will provide a product which may not be able to be resold, or will be resold at a used or second-hand value. The tokens sold in an ICO on the other hand, may be used to access a product, or sold on a second-hand market. These tokens can appreciate in value, and be resold for a higher price than they were purchased for, but the SEC advises that investors and companies don’t view them in this way (again, we’ll talk about this more in a later post on ICO regulations).

The audiences do differ slightly as well, since crowdfunding appeals to the common person, but ICOs, at least at the current time, are often targeting more technical individuals and cyrpto investors.

Should You Launch an ICO?

Because of the enormous opportunity in the ICO space, it’s an appealing option for many entrepreneurs and businesses. Just because it’s appealing however doesn’t mean it’s the right call for funding your own startup.

There are a lot of regulatory considerations, and the target audience can be quite demanding. You really must know what you are doing (or outsource to an agency) in order to have a successful ICO. Plus, ICOs can be quite expensive and require developer knowledge/talent. There are some promising solutions on the horizon which may make it so that any entrepreneur or organization can create their own token without developer experience, but that technology isn’t here yet.

A great way to look at things are as follows: Does your business idea make sense without the token? If so, skip the ICO.

Typically successful Initial Coin Offerings work when the token is an integral part of the service being offered. Here are some of the biggest ICOs of the last couple years to give you an idea of when an ICO may make sense: